Mr. Buffett released his annual letter on Feb 27,1009 to Berkshire Hathaway Inc and said the economic turmoil that contributed to a 62 per cent profit drop last year at the holding company he controls is certain to continue in 2009, but the revered investor remains optimistic.

"Though the path has not been smooth, our economic system has worked extraordinarily well over time," Mr. Buffett wrote. "It has unleashed human potential as no other system has, and it will continue to do so. America's best days lie ahead."

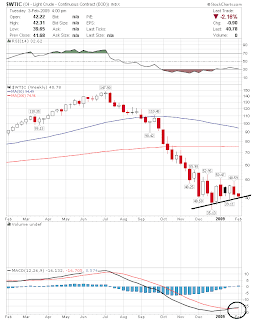

Mr. Buffett said he made at least one major investing mistake last year by buying a large amount of ConocoPhillips (COP) stock when oil and gas prices were near their peak. Berkshire increased its stake in ConocoPhillips from 17.5 million shares in 2007 to 84.9 million shares at the end of 2008. Mr. Buffett said he did not anticipate last year's dramatic fall in energy prices, so his decision cost Berkshire shareholders several billion dollars.

Mr. Buffett says he also spent $244-million on stock in two Irish banks that appeared cheap. But since then, he's had to write down the value of those purchases to $27-million.

Berkshire owns a diverse mix of more than 60 companies, including insurance, furniture, carpet, jewellery, restaurants and utility businesses. And it has major investments in such companies as Wells Fargo & Co. and Coca-Cola Co.

Saturday, February 28, 2009

Thursday, February 26, 2009

Friday, February 20, 2009

Thursday, February 19, 2009

Barclay bullish on Suncor

Paul Chen, an analyst at Barclays, said in a note to clients that Suncor has the clearest growth prospects of the Canadian oil sands producers. He raised his recommendation on the stock to “overweight” from “equal weight” - the first time since 1999 that the analyst has been bullish on the stock.

“We expect both capital and operating costs for oil sands projects to come down, which should help add further upside,” Mr. Cheng said in his report, according to Bloomberg News. “Management's new focus on improving reliability and getting the most from the assets in the ground should help restore its reputation as a good operator.”

He believes that the stock is worth $42 – representing a potential gain of 76 per cent from its current level of $23.87 – if the price of crude oil gets to a long-term average of $80 (U.S.) a barrel.

“We expect both capital and operating costs for oil sands projects to come down, which should help add further upside,” Mr. Cheng said in his report, according to Bloomberg News. “Management's new focus on improving reliability and getting the most from the assets in the ground should help restore its reputation as a good operator.”

He believes that the stock is worth $42 – representing a potential gain of 76 per cent from its current level of $23.87 – if the price of crude oil gets to a long-term average of $80 (U.S.) a barrel.

Wednesday, February 11, 2009

Goldcorp Founder McEwen Bets Gold to $5,000

Goldcorp Inc. founder Rob McEwen said he expects the metal to top $5,000 an ounce as governments increase the money supply to combat recession.

Bullion will more than double to $2,000 an ounce by the end of next year before rising to McEwen’s target by the end of the cycle, which could take an additional four years, the investor said.

McEwen said he has a “big, big” holding in bullion since August 2007, at the beginning of the subprime mortgage crisis. “I realized we had reached an inflection point regarding money,” McEwen said. “It was all about protecting money, and gold served that purpose.”

Bullion will more than double to $2,000 an ounce by the end of next year before rising to McEwen’s target by the end of the cycle, which could take an additional four years, the investor said.

McEwen said he has a “big, big” holding in bullion since August 2007, at the beginning of the subprime mortgage crisis. “I realized we had reached an inflection point regarding money,” McEwen said. “It was all about protecting money, and gold served that purpose.”

Saturday, February 7, 2009

Gold Price Higher than Dow Index?

Interview with Dr. Marc Faber (aka Dr. Doom) February 06, 2009 on Bloomberg.

Friday, February 6, 2009

Bullish chart for XGD

The fundamental of Gold can not be more bullish nowadays. The ETF XGD which traded in Toronto Exchange obviously tell the story. The 50 days average has crossed over 200 days average.

Q & A from Mr.Jim Sinclair today

Q. What is an Economic Stimulus Payment?

A. It is money that the federal government will send to taxpayers..

Q. Where will the government get this money?

A. From taxpayers.

Q. So the government is giving me back my own money?

A. No, they are borrowing it from China. Your children are expected to repay the Chinese.

Q. What is the purpose of this payment?

A. The plan is that you will use the money to purchase a high-definition TV set, thus stimulating the economy.

Q. But isn’t that stimulating the economy of China?

A. Shut up."

A. It is money that the federal government will send to taxpayers..

Q. Where will the government get this money?

A. From taxpayers.

Q. So the government is giving me back my own money?

A. No, they are borrowing it from China. Your children are expected to repay the Chinese.

Q. What is the purpose of this payment?

A. The plan is that you will use the money to purchase a high-definition TV set, thus stimulating the economy.

Q. But isn’t that stimulating the economy of China?

A. Shut up."

Are we going to rely on wife's payroll

With the recession on the brink of becoming the longest in the postwar era, a milestone may be at hand: Women are poised to surpass men on the nation’s payrolls, taking the majority for the first time in American history.

The reason has less to do with gender equality than with where the ax is falling.

The proportion of women who are working has changed very little since the recession started. But a full 82 percent of the job losses have befallen men, who are heavily represented in distressed industries like manufacturing and construction. Women tend to be employed in areas like education and health care, which are less sensitive to economic ups and downs, and in jobs that allow more time for child care and other domestic work.

“Given how stark and concentrated the job losses are among men, and that women represented a high proportion of the labor force in the beginning of this recession, women are now bearing the burden — or the opportunity, one could say — of being breadwinners,” says Heather Boushey, a senior economist at the Center for American Progress.

Economists have predicted before that women would one day dominate the labor force as more ventured outside the home. The number of women entering the work force slowed and even dipped during the boom years earlier this decade, though, prompting a debate about whether women truly wanted to be both breadwinners and caregivers.

Should the male-dominated layoffs of the current recession continue — and Friday’s jobs report for January may offer more insight — the debate will be moot. A deep and prolonged recession, therefore, may change not only household budgets and habits; it may also challenge longstanding gender roles.

In recessions, the percentage of families supported by women tends to rise slightly, and it is expected to do so when this year’s numbers are tallied. As of November, women held 49.1 percent of the nation’s jobs, according to nonfarm payroll data collected by the Bureau of Labor Statistics. By another measure, including farm workers and the self-employed, women constituted 47.1 percent of the work force.

Women may be safer in their jobs, but tend to find it harder to support a family. For one thing, they work fewer overall hours than men. Women are much more likely to be in part-time jobs without health insurance or unemployment insurance. Even in full-time jobs, women earn 80 cents for each dollar of their male counterparts’ income, according to the government data.

“A lot of jobs that men have lost in fields like manufacturing were good union jobs with great health care plans,” says Christine Owens, executive director of the National Employment Law Project. “The jobs women have — and are supporting their families with — are not necessarily as good.”

Nasreen Mohammed, for example, works five days a week, 51 weeks a year, without sick days or health benefits.

She runs a small day care business out of her home in Milpitas, Calif., and recently expanded her services to include after-school care. The business brings in about $30,000 annually, she says, far less than the $150,000 her husband earned in the marketing and sales job he lost over a year ago. “It’s peanuts,” she says.

She switched from being a full-time homemaker to a full-time businesswoman when her husband was laid off previously. She says she unexpectedly discovered that she loves her job, even if it is demanding.

Still, her husband, Javed, says he and their three children — who are in third grade, junior college and law school — worry about her health, and hope things can “return to the old days.”

“In terms of the financial benefit from her work, we all benefit,” he says. “But in terms of getting my wife’s attention, from the youngest daughter to our oldest, we can’t wait for the day that my job is secure and she doesn’t have to do day care anymore.”

Women like Ms. Mohammed find themselves at the head of once-separate spheres: work and household. While women appear to be sole breadwinners in greater numbers, they are likely to remain responsible for most domestic responsibilities at home.

On average, employed women devote much more time to child care and housework than employed men do, according to recent data from the government’s American Time Use Survey analyzed by two economists, Alan B. Krueger and Andreas Mueller.

When women are unemployed and looking for a job, the time they spend daily taking care of children nearly doubles. Unemployed men’s child care duties, by contrast, are virtually identical to those of their working counterparts, and they instead spend more time sleeping, watching TV and looking for a job, along with other domestic activities.

Many of the unemployed men interviewed say they have tried to help out with cooking, veterinarian appointments and other chores, but they have not had time to do more because job-hunting consumes their days.

“The main priority is finding a job and putting in the time to do that,” says John Baruch, in Arlington Heights, Ill., who estimates he spends 35 to 45 hours a week looking for work since being laid off in January 2008.

While he has helped care for his wife’s aging parents, the couple still sometimes butt heads over who does things like walking the dog, now that he is out of work. He puts it this way: “As one of the people who runs one of the career centers I’ve been to told me: ‘You’re out of a job, but it’s not your time to paint the house and fix the car. Your job is about finding the next job.’ ”

Many women say they expect their family roles to remain the same, even if economic circumstances have changed for now.

“I don’t know if I’d really call myself a ‘breadwinner,’ since I earn practically nothing,” says Linda Saxby, who assists the librarian at the Cypress, Tex., high school her two daughters attend. Her husband, whose executive-level position was eliminated last May, had been earning $225,000, and the family is now primarily living off savings.

Historically, the way couples divide household jobs has been fairly resistant to change, says Heidi Hartmann, president and chief economist at the Institute for Women’s Policy Research.

“Over a long, 20-year period, married men have stepped up to the plate a little bit, but not as much as married women have dropped off in the time they spend on household chores,” Ms. Hartmann says. This suggests some domestic duties have been outsourced, as when takeout substitutes for cooking, for example. And as declining incomes force families to cut back on these outlays, she says, “women will most likely pick up the slack.”

A severe recession could put pressure on these roles.

“It has definitely put a strain” on my marriage, says Debbie Harlan, an executive assistant at a hospital system in Sarasota, Fla. Four months ago, her husband closed his 10-year-old independent car sales business, and the couple have been asking their children to help with bills. “So far we’ve worked through it, but there have been times when I wasn’t sure we could.”

The Mohammeds say things are not as stressful as they were the last time Mr. Mohammed lost his job. He has been helping out with the cooking and with paperwork for his wife’s business, and she says she works to prop up family morale.

“Things are not happy in the house if I blame him all the time, so I don’t do any of that anymore,” Ms. Mohammed says. “I know he is doing his best.”

The reason has less to do with gender equality than with where the ax is falling.

The proportion of women who are working has changed very little since the recession started. But a full 82 percent of the job losses have befallen men, who are heavily represented in distressed industries like manufacturing and construction. Women tend to be employed in areas like education and health care, which are less sensitive to economic ups and downs, and in jobs that allow more time for child care and other domestic work.

“Given how stark and concentrated the job losses are among men, and that women represented a high proportion of the labor force in the beginning of this recession, women are now bearing the burden — or the opportunity, one could say — of being breadwinners,” says Heather Boushey, a senior economist at the Center for American Progress.

Economists have predicted before that women would one day dominate the labor force as more ventured outside the home. The number of women entering the work force slowed and even dipped during the boom years earlier this decade, though, prompting a debate about whether women truly wanted to be both breadwinners and caregivers.

Should the male-dominated layoffs of the current recession continue — and Friday’s jobs report for January may offer more insight — the debate will be moot. A deep and prolonged recession, therefore, may change not only household budgets and habits; it may also challenge longstanding gender roles.

In recessions, the percentage of families supported by women tends to rise slightly, and it is expected to do so when this year’s numbers are tallied. As of November, women held 49.1 percent of the nation’s jobs, according to nonfarm payroll data collected by the Bureau of Labor Statistics. By another measure, including farm workers and the self-employed, women constituted 47.1 percent of the work force.

Women may be safer in their jobs, but tend to find it harder to support a family. For one thing, they work fewer overall hours than men. Women are much more likely to be in part-time jobs without health insurance or unemployment insurance. Even in full-time jobs, women earn 80 cents for each dollar of their male counterparts’ income, according to the government data.

“A lot of jobs that men have lost in fields like manufacturing were good union jobs with great health care plans,” says Christine Owens, executive director of the National Employment Law Project. “The jobs women have — and are supporting their families with — are not necessarily as good.”

Nasreen Mohammed, for example, works five days a week, 51 weeks a year, without sick days or health benefits.

She runs a small day care business out of her home in Milpitas, Calif., and recently expanded her services to include after-school care. The business brings in about $30,000 annually, she says, far less than the $150,000 her husband earned in the marketing and sales job he lost over a year ago. “It’s peanuts,” she says.

She switched from being a full-time homemaker to a full-time businesswoman when her husband was laid off previously. She says she unexpectedly discovered that she loves her job, even if it is demanding.

Still, her husband, Javed, says he and their three children — who are in third grade, junior college and law school — worry about her health, and hope things can “return to the old days.”

“In terms of the financial benefit from her work, we all benefit,” he says. “But in terms of getting my wife’s attention, from the youngest daughter to our oldest, we can’t wait for the day that my job is secure and she doesn’t have to do day care anymore.”

Women like Ms. Mohammed find themselves at the head of once-separate spheres: work and household. While women appear to be sole breadwinners in greater numbers, they are likely to remain responsible for most domestic responsibilities at home.

On average, employed women devote much more time to child care and housework than employed men do, according to recent data from the government’s American Time Use Survey analyzed by two economists, Alan B. Krueger and Andreas Mueller.

When women are unemployed and looking for a job, the time they spend daily taking care of children nearly doubles. Unemployed men’s child care duties, by contrast, are virtually identical to those of their working counterparts, and they instead spend more time sleeping, watching TV and looking for a job, along with other domestic activities.

Many of the unemployed men interviewed say they have tried to help out with cooking, veterinarian appointments and other chores, but they have not had time to do more because job-hunting consumes their days.

“The main priority is finding a job and putting in the time to do that,” says John Baruch, in Arlington Heights, Ill., who estimates he spends 35 to 45 hours a week looking for work since being laid off in January 2008.

While he has helped care for his wife’s aging parents, the couple still sometimes butt heads over who does things like walking the dog, now that he is out of work. He puts it this way: “As one of the people who runs one of the career centers I’ve been to told me: ‘You’re out of a job, but it’s not your time to paint the house and fix the car. Your job is about finding the next job.’ ”

Many women say they expect their family roles to remain the same, even if economic circumstances have changed for now.

“I don’t know if I’d really call myself a ‘breadwinner,’ since I earn practically nothing,” says Linda Saxby, who assists the librarian at the Cypress, Tex., high school her two daughters attend. Her husband, whose executive-level position was eliminated last May, had been earning $225,000, and the family is now primarily living off savings.

Historically, the way couples divide household jobs has been fairly resistant to change, says Heidi Hartmann, president and chief economist at the Institute for Women’s Policy Research.

“Over a long, 20-year period, married men have stepped up to the plate a little bit, but not as much as married women have dropped off in the time they spend on household chores,” Ms. Hartmann says. This suggests some domestic duties have been outsourced, as when takeout substitutes for cooking, for example. And as declining incomes force families to cut back on these outlays, she says, “women will most likely pick up the slack.”

A severe recession could put pressure on these roles.

“It has definitely put a strain” on my marriage, says Debbie Harlan, an executive assistant at a hospital system in Sarasota, Fla. Four months ago, her husband closed his 10-year-old independent car sales business, and the couple have been asking their children to help with bills. “So far we’ve worked through it, but there have been times when I wasn’t sure we could.”

The Mohammeds say things are not as stressful as they were the last time Mr. Mohammed lost his job. He has been helping out with the cooking and with paperwork for his wife’s business, and she says she works to prop up family morale.

“Things are not happy in the house if I blame him all the time, so I don’t do any of that anymore,” Ms. Mohammed says. “I know he is doing his best.”

Thursday, February 5, 2009

Goldman Sachs forecast $1,000 gold in 3 months

According to Reuters today Goldman Sachs lifted its three-month gold forecast to $1,000 an ounce from $700 an ounce, citing safe-haven demand for gold.

"The gold price rally has been driven by surging demand for gold in all forms: physical gold, exchange traded funds and futures contracts and investors seek a 'safe store of value'," the bank said in a note.

"It is also important to emphasise that the recent strong demand for gold has not been irrational, but rather pretty much in line with the probabilities of financial and sovereign default."

"The gold price rally has been driven by surging demand for gold in all forms: physical gold, exchange traded funds and futures contracts and investors seek a 'safe store of value'," the bank said in a note.

"It is also important to emphasise that the recent strong demand for gold has not been irrational, but rather pretty much in line with the probabilities of financial and sovereign default."

Wednesday, February 4, 2009

Merrill Lynch CIO predicted gold prices could hit $1,500

Wednesday, February 04, 2009

Business 24|7

Gold prices may hit $1,500 an ounce in the next 12 to 15 months, Gary Dugan, the Chief Investment Officer (CIO) of Merrill Lynch, said yesterday.

Dugan termed his apprehensions of gold striking such a high as a "fear" that may come true. He reasoned that such a price would mean the other commodities and streams of investments have been shunned by investors.

With confidence in currencies shaken to the core, the yellow metal is increasingly assuming the role of "the most trusted currency", Dugan said. "We have never seen such a rush to buy gold. It's bringing in security and it's still affordable."

Merrill Lynch commodity price forecast authored by Dugan showed that gold prices can rise from the currently prevailing $913/oz to $1,100/oz in the first quarter of 2009 and to $1,150/oz in the second quarter. "While demand for gold has been rising production has been declining. South Africa, which accounts for the major share of global gold production, is facing political issues and has energy problems," Dugan said.

With reports of declining returns from other investment options, "cash" – keeping money safe in banks and investing in government bonds – is the option in front of investors, Dugan said.

"Fear" and eventual decline of the greenback are the two factors that will drive gold prices, he said. While commodity markets could also bounce back in the first half of the year, a rebound is likely to be short-lived in the absence of strong US consumer demand.

Precious metals, led by gold, could enjoy a more sustained rally with gold benefiting from a weakening of the dollar in the second half of the year, Dugan said.

Dugan said the greenback, which has been strengthening for the past few months, will decline in value by the middle of this year. "That's when people will begin to realise that President Obama's policies are not having the desired impact," he said.

Investors could also look to private equity, which produced strong returns during the downturns in 1991 and 2001, on an opportunistic basis. Some hedge fund strategies may be worth following but hedge funds should be treated with caution, Dugan said.

Returns from private equity should remain in single digits in 2009 and a return of beyond 10 per cent should be treated as "fair value", he said. "Investors should remain cautious. They need to be prepared to take profits. We think any such rally would run out of steam by the second half of the year."

Low risk assets could offer private investors the best prospects of attractive returns in 2009 as the world's leading industrialised nations face recession, Dugan said. With governments around the world striving to tackle the economic crisis, private investors could find value in a cautious approach towards asset allocation. Options include high-grade corporate bonds and high-quality, high-yielding equities in defensive industries.

"Investors will look to long-term US government bonds as an important barometer of the progress of global recovery," said Dugan. "Sharply rising bond yields will show that the governments have overspent."

While earnings downgrades are likely to dominate the first quarter of 2009, a rally in global equity markets could be on the cards for the first half of the year with consumer and cyclical stocks among the potential beneficiaries, Dugan said.

Broad equities indices could also offer trading opportunities to private investors. "Equities could outperform as an asset class in 2009 unless there is a serious deflation risk. Our view is that deflation will be avoided," he added.

Selective investment in high-grade corporate bonds could also provide attractive returns, Dugan said.

Business 24|7

Gold prices may hit $1,500 an ounce in the next 12 to 15 months, Gary Dugan, the Chief Investment Officer (CIO) of Merrill Lynch, said yesterday.

Dugan termed his apprehensions of gold striking such a high as a "fear" that may come true. He reasoned that such a price would mean the other commodities and streams of investments have been shunned by investors.

With confidence in currencies shaken to the core, the yellow metal is increasingly assuming the role of "the most trusted currency", Dugan said. "We have never seen such a rush to buy gold. It's bringing in security and it's still affordable."

Merrill Lynch commodity price forecast authored by Dugan showed that gold prices can rise from the currently prevailing $913/oz to $1,100/oz in the first quarter of 2009 and to $1,150/oz in the second quarter. "While demand for gold has been rising production has been declining. South Africa, which accounts for the major share of global gold production, is facing political issues and has energy problems," Dugan said.

With reports of declining returns from other investment options, "cash" – keeping money safe in banks and investing in government bonds – is the option in front of investors, Dugan said.

"Fear" and eventual decline of the greenback are the two factors that will drive gold prices, he said. While commodity markets could also bounce back in the first half of the year, a rebound is likely to be short-lived in the absence of strong US consumer demand.

Precious metals, led by gold, could enjoy a more sustained rally with gold benefiting from a weakening of the dollar in the second half of the year, Dugan said.

Dugan said the greenback, which has been strengthening for the past few months, will decline in value by the middle of this year. "That's when people will begin to realise that President Obama's policies are not having the desired impact," he said.

Investors could also look to private equity, which produced strong returns during the downturns in 1991 and 2001, on an opportunistic basis. Some hedge fund strategies may be worth following but hedge funds should be treated with caution, Dugan said.

Returns from private equity should remain in single digits in 2009 and a return of beyond 10 per cent should be treated as "fair value", he said. "Investors should remain cautious. They need to be prepared to take profits. We think any such rally would run out of steam by the second half of the year."

Low risk assets could offer private investors the best prospects of attractive returns in 2009 as the world's leading industrialised nations face recession, Dugan said. With governments around the world striving to tackle the economic crisis, private investors could find value in a cautious approach towards asset allocation. Options include high-grade corporate bonds and high-quality, high-yielding equities in defensive industries.

"Investors will look to long-term US government bonds as an important barometer of the progress of global recovery," said Dugan. "Sharply rising bond yields will show that the governments have overspent."

While earnings downgrades are likely to dominate the first quarter of 2009, a rally in global equity markets could be on the cards for the first half of the year with consumer and cyclical stocks among the potential beneficiaries, Dugan said.

Broad equities indices could also offer trading opportunities to private investors. "Equities could outperform as an asset class in 2009 unless there is a serious deflation risk. Our view is that deflation will be avoided," he added.

Selective investment in high-grade corporate bonds could also provide attractive returns, Dugan said.

John Paulson: Bearish for Now

Hedge fund head John Paulson — who continues to make huge profits for his investors while other managers continue to drown in red — ink remains bearish going into 2009.

“The sharp contraction in the global economy, the instability of the global financial system and the ongoing credit contraction are unlikely to be resolved in the first half of 2009,” Paulson wrote in his year-end letter to investors.

Paulson's two credit funds were up 19 percent and 16 percent respectively last year, avoiding buying distressed debt such as mortgages and leveraged loans even though both were trading at what appeared to be attractive prices.

Instead, the fund essentially bet against the debt of several financial institutions by purchasing credit-default swaps.

Now, Paulson remains short financial stocks and slightly short of the equity markets in general but sees a big opportunity in buying distressed debt.

“The biggest driver for 2009 and 2010 will be in long distressed opportunities,” he says.

“We estimate the potential size of the distressed market to approach $10 trillion.”

Two-thirds of the several hundred asset managers who responded to a recent survey said they plan to raise more money and increase their investments in distressed debt this year, The Wall Street Journal reports.

One-third believe the first quarter is the right time to buy, and more than half are expecting it to pay off smartly, projecting 20 percent returns or more for the year.

“The sharp contraction in the global economy, the instability of the global financial system and the ongoing credit contraction are unlikely to be resolved in the first half of 2009,” Paulson wrote in his year-end letter to investors.

Paulson's two credit funds were up 19 percent and 16 percent respectively last year, avoiding buying distressed debt such as mortgages and leveraged loans even though both were trading at what appeared to be attractive prices.

Instead, the fund essentially bet against the debt of several financial institutions by purchasing credit-default swaps.

Now, Paulson remains short financial stocks and slightly short of the equity markets in general but sees a big opportunity in buying distressed debt.

“The biggest driver for 2009 and 2010 will be in long distressed opportunities,” he says.

“We estimate the potential size of the distressed market to approach $10 trillion.”

Two-thirds of the several hundred asset managers who responded to a recent survey said they plan to raise more money and increase their investments in distressed debt this year, The Wall Street Journal reports.

One-third believe the first quarter is the right time to buy, and more than half are expecting it to pay off smartly, projecting 20 percent returns or more for the year.

UBS grows more bullish on gold and silver

One of the best performing assets of 2008 is expected to have another good year in 2009. Despite adverse moves in three of gold’s most powerful drivers – a stronger U.S. dollar particularly against European currencies, the sharp decline for crude oil and rapidly falling inflation – UBS has increased its forecasts for gold and silver as it sees both investor and speculative interest boosting prices, even as jewellery demand falls and the U.S. dollar strengthens.

Its gold price targets for 2009 and 2010 move from US$700 per ounce for both years to US$1000 and US$900, respectively. UBS’s silver forecasts climb from US$8.40 and US$8.95 per ounce to US$14.75 and US$12.80, respectively.

“Purchases of physical gold have jumped over the past six months as investors’ fears about the current financial crisis and the possible outcomes from government efforts to support banks and economies have intensified,” UBS strategist John Reade told clients.

The European bank estimates that investment demand will double in 2009 compared to 2007, which will drive gold to an average of US$1000. It expects this safe haven buying to decline in 2010.

Based on the implied returns from these changes, UBS upgraded Agnico-Eagle Mines Ltd., Barrick Gold Corp., Eldorado Gold Corp., Newmont Mining Corp. and Goldcorp Inc. from “neutral” to “buy,” while maintaining “buy” ratings on Centerra Gold Inc. and Franco-Nevada Corp.

The firm also noted that precious metals remain its preferred investments in a commodity context and it anticipates that gold and platinum equities could continue to outperform. It favours names like Impala Platinum Holdings Ltd., Barrick and Goldcorp.

Its gold price targets for 2009 and 2010 move from US$700 per ounce for both years to US$1000 and US$900, respectively. UBS’s silver forecasts climb from US$8.40 and US$8.95 per ounce to US$14.75 and US$12.80, respectively.

“Purchases of physical gold have jumped over the past six months as investors’ fears about the current financial crisis and the possible outcomes from government efforts to support banks and economies have intensified,” UBS strategist John Reade told clients.

The European bank estimates that investment demand will double in 2009 compared to 2007, which will drive gold to an average of US$1000. It expects this safe haven buying to decline in 2010.

Based on the implied returns from these changes, UBS upgraded Agnico-Eagle Mines Ltd., Barrick Gold Corp., Eldorado Gold Corp., Newmont Mining Corp. and Goldcorp Inc. from “neutral” to “buy,” while maintaining “buy” ratings on Centerra Gold Inc. and Franco-Nevada Corp.

The firm also noted that precious metals remain its preferred investments in a commodity context and it anticipates that gold and platinum equities could continue to outperform. It favours names like Impala Platinum Holdings Ltd., Barrick and Goldcorp.

Tuesday, February 3, 2009

Eric Sprott said bullion may top $2,000 an ounce in coming years

Feb. 3 (Bloomberg) -- Eric Sprott, the Canadian money manager who last year predicted banking stocks would collapse, said the U.S. is at the beginning of an economic depression that will help gold prices more than double.

Bullion may top $2,000 an ounce in coming years amid a series of financial catastrophes, the chairman and founder of Toronto-based Sprott Asset Management Inc. said yesterday in an interview. Banks will battle to replenish capital, Treasury auctions stand the risk of failing and the moribund economy will create a dire operating outlook for many companies, he said.

“The trend is down, and there’s not one signpost that says it’s changing yet,” Sprott said yesterday from Toronto. “We’ll stand by to wait to see those, and until it does, you have to assume it gets worse.”

Sprott, who manages $4.5 billion, said in March that the world was in a “systemic financial meltdown,” a call that presaged the collapse of financial institutions including Bear Stearns & Co. and Lehman Brothers Holdings Inc. Since then, the U.S. has entered the worst economic slowdown since the Great Depression, credit markets have tightened and asset prices have dropped as companies and funds sell portfolios to raise cash.

The 81-company Standard & Poor’s 500 Financials Index has dropped 62 percent since Sprott said on March 6 he was buying bullion and gold-producers’ shares, while shorting financial- sector stocks. Gold slipped 6.3 percent during the same period.

So-called short-selling allows speculators to profit from a stock’s decline by borrowing shares, selling them to raise cash and buying them later when the price drops to repay the debt.

Sprott Funds

Sprott Hedge Fund LP posted a one-year return of 9.9 percent, while Sprott Hedge Fund LP II rose 18 percent in the period, according to data posted on the company’s Web site. The Sprott Canadian Equity Fund dropped 37 percent.

Sprott now favors buying more gold stocks and bullion while selling the entire equity market short. Most at risk in the current climate are banks, discretionary consumer stocks and any companies needing to refinance debt, he said.

Sprott believes there is a chance that a U.S. Treasury auction will fail as countries use their resources to quell financial turmoil in their home markets, leaving less to help finance the world’s largest economy. That outcome will have a “catastrophic” impact, he said.

“When do people stop buying the credit of the country? That’s a tough question to answer, but it’s on a lot of people’s lips right now,” he said. “Each country has their own financial problem, so there’s no funding for anything external.”

Gold Investors

Such concerns have driven investors to the gold market, propelling the metal higher as other commodities have slumped and helping gold-producers’ stocks almost double in the past three months.

Greenlight Capital Inc., a $5.1 billion New York-based hedge fund, has invested in gold for the first time, while Federated Investors Inc.’s $1.3 billion Federated Market Opportunity Fund, which outperformed 99 percent of rivals last year, now counts Yamana Gold Inc. and Goldcorp Inc. among its largest investments.

Gold companies such as Newmont Mining Corp. and Kinross Gold Corp. have taken the opportunity to issue stock to bolster their own balance sheets.

Barrick Gold Corp. Chairman Peter Munk said last week he has been inundated with calls from wealthy investors seeking to buy gold to protect their capital.

“The window to raise money for gold stocks has blown open,” Sprott said. “The investing public has started to go to that one thing that they think it’s safe to invest in.”

Bullion may top $2,000 an ounce in coming years amid a series of financial catastrophes, the chairman and founder of Toronto-based Sprott Asset Management Inc. said yesterday in an interview. Banks will battle to replenish capital, Treasury auctions stand the risk of failing and the moribund economy will create a dire operating outlook for many companies, he said.

“The trend is down, and there’s not one signpost that says it’s changing yet,” Sprott said yesterday from Toronto. “We’ll stand by to wait to see those, and until it does, you have to assume it gets worse.”

Sprott, who manages $4.5 billion, said in March that the world was in a “systemic financial meltdown,” a call that presaged the collapse of financial institutions including Bear Stearns & Co. and Lehman Brothers Holdings Inc. Since then, the U.S. has entered the worst economic slowdown since the Great Depression, credit markets have tightened and asset prices have dropped as companies and funds sell portfolios to raise cash.

The 81-company Standard & Poor’s 500 Financials Index has dropped 62 percent since Sprott said on March 6 he was buying bullion and gold-producers’ shares, while shorting financial- sector stocks. Gold slipped 6.3 percent during the same period.

So-called short-selling allows speculators to profit from a stock’s decline by borrowing shares, selling them to raise cash and buying them later when the price drops to repay the debt.

Sprott Funds

Sprott Hedge Fund LP posted a one-year return of 9.9 percent, while Sprott Hedge Fund LP II rose 18 percent in the period, according to data posted on the company’s Web site. The Sprott Canadian Equity Fund dropped 37 percent.

Sprott now favors buying more gold stocks and bullion while selling the entire equity market short. Most at risk in the current climate are banks, discretionary consumer stocks and any companies needing to refinance debt, he said.

Sprott believes there is a chance that a U.S. Treasury auction will fail as countries use their resources to quell financial turmoil in their home markets, leaving less to help finance the world’s largest economy. That outcome will have a “catastrophic” impact, he said.

“When do people stop buying the credit of the country? That’s a tough question to answer, but it’s on a lot of people’s lips right now,” he said. “Each country has their own financial problem, so there’s no funding for anything external.”

Gold Investors

Such concerns have driven investors to the gold market, propelling the metal higher as other commodities have slumped and helping gold-producers’ stocks almost double in the past three months.

Greenlight Capital Inc., a $5.1 billion New York-based hedge fund, has invested in gold for the first time, while Federated Investors Inc.’s $1.3 billion Federated Market Opportunity Fund, which outperformed 99 percent of rivals last year, now counts Yamana Gold Inc. and Goldcorp Inc. among its largest investments.

Gold companies such as Newmont Mining Corp. and Kinross Gold Corp. have taken the opportunity to issue stock to bolster their own balance sheets.

Barrick Gold Corp. Chairman Peter Munk said last week he has been inundated with calls from wealthy investors seeking to buy gold to protect their capital.

“The window to raise money for gold stocks has blown open,” Sprott said. “The investing public has started to go to that one thing that they think it’s safe to invest in.”

Subscribe to:

Posts (Atom)