One Year Older

One Year Wiser

Monday, December 31, 2007

Thursday, December 20, 2007

Geologix Has Ambitions To Rival Penasquito

Canadian listed Geologix Explorations does not believe in spreading its operations around the world so all its projects are in North and South America – specifically Nevada, Mexico and Peru. Its management is grounded in geology from its chairman Robert Willis who played a key role in founding and developing Manhattan Minerals. Under his direction, Manhattan explored many gold and silver projects in Mexico and most notably explored, developed, and financed into production the 2200 tonnes/day Moris open pit heap leach gold mine. He is supported by Dunham Craig, the chief executive who is also a geologist, and he was responsible for discovering 3 new deposits at the Golden Bear Mine for Wheaton River Minerals and subsequent development of the bankable feasibility mining program that lead to the profitable operations for Wheaton.

This caucus is rounded off by Sig Weidner who spent 18 years with Rio Algom /Billiton/BHP Billiton where he was involved throughout the exploration cycle from greenfields exploration, through pre-feasibility to being manager of operations in North America and Europe. During that time he was awarded the Prospector of the Year (New Brunswick PDAC branch) award in 1993 and the international Bill Dennis (PDAC) Prospector of the Year award in 1998 for the discovery of the Spence Porphyry Copper deposit in Chile. A formidable team which knows what it is about and spends its money in the ground rather than mining the market. They are seeking gold deposits of size and have a balance of early and late stage projects.

San Agustin in Durango state, Mexico, is being acquired from Silver Standard. The deal is not the usual farm-in arrangement as Geologix has to carry out 15,000 metres of drilling before estimating a resource over an agreed area. It can then buy the resource for US$15/ oz gold and US$1/ oz silver provided the price of gold is below US$750/oz and silver below US$20/oz. Above these two price bases, the costs rise to US$20/oz gold and US$1.50/oz silver. No charge is made for any zinc or lead discovered and Geologix also pays nothing for any discovery outside the defined drill plan, though it has to give Silver Standard a 2.5 per cent net smelter royalty.

As a starting point when the deal was agreed last summer the inferred resource amounted to 436,000 ozs gold equivalent. Since then the company has carried out 6 kms of trenching, more than 8,000 metres of drilling and has another 10,000 metres to complete. Two recent announcements confirm that there is a new and significant target area of mineralization on the property which should add to the existing drill defined targets as it has all the signatures of the other zones on the property. Early this month a couple more 150 metre drill holes extended the mineralization even further on the northern edge of the Zone 2 area and grades of gold, silver and zinc increased at depth with the holes ending in mineralization As Dunham Craig pointed out, "our drilling continues to discover additional high grade in both Zones 2 and 4. These zones of increased grade greatly enhance the project's future economics when considering a large bulk mineable polymetallic deposit.

The interesting thing about San Agustin is that the deposit appears to consist of two different types of mineralization. Northeast of the historical resource it is primarily in higher grade gold-silver structures, whereas to the south west of the historical resource there seems to be an extensive system of gold-silver-zinc-lead mineralization Comparisons were made by Sig Weidner, when he was in London recently, with the Penasquito mine, also in Mexico, where Goldcorp intends to expand production to around 1.7 million ounces of gold equivalent at a capital cost of US$1.49 million. If this comparison holds up Geologix will really be onto something and the resource calculation due next summer should reveal a lot.

The company also has a strategic alliance with Newmont in central Peru where first-pass regional geochemical evaluation consisting of Newmont's proprietary BLEG technique as well as stream-sediment and rock sampling of the Alliance's 11,000 square kilometres has now been completed. Over 14,800 samples have been collected within the alliance boundary that provide a comprehensive and compelling database for definition of anomalous areas. Follow-up geological investigation of numerous identified targets is underway and this will have priority over the other early stage projects in Peru which Geologix has a 100 per cent interest.

Its projects in Nevada are slightly more advanced and some are being considered for joint ventures to limit the company's exploration spend. Some drilling is taking place at the OZ project and the QC project will be drilled next summer. Most of the investment interest is, however, focused on San Agustin and the build-up to the resource estimate next year should be worth monitoring.

This caucus is rounded off by Sig Weidner who spent 18 years with Rio Algom /Billiton/BHP Billiton where he was involved throughout the exploration cycle from greenfields exploration, through pre-feasibility to being manager of operations in North America and Europe. During that time he was awarded the Prospector of the Year (New Brunswick PDAC branch) award in 1993 and the international Bill Dennis (PDAC) Prospector of the Year award in 1998 for the discovery of the Spence Porphyry Copper deposit in Chile. A formidable team which knows what it is about and spends its money in the ground rather than mining the market. They are seeking gold deposits of size and have a balance of early and late stage projects.

San Agustin in Durango state, Mexico, is being acquired from Silver Standard. The deal is not the usual farm-in arrangement as Geologix has to carry out 15,000 metres of drilling before estimating a resource over an agreed area. It can then buy the resource for US$15/ oz gold and US$1/ oz silver provided the price of gold is below US$750/oz and silver below US$20/oz. Above these two price bases, the costs rise to US$20/oz gold and US$1.50/oz silver. No charge is made for any zinc or lead discovered and Geologix also pays nothing for any discovery outside the defined drill plan, though it has to give Silver Standard a 2.5 per cent net smelter royalty.

As a starting point when the deal was agreed last summer the inferred resource amounted to 436,000 ozs gold equivalent. Since then the company has carried out 6 kms of trenching, more than 8,000 metres of drilling and has another 10,000 metres to complete. Two recent announcements confirm that there is a new and significant target area of mineralization on the property which should add to the existing drill defined targets as it has all the signatures of the other zones on the property. Early this month a couple more 150 metre drill holes extended the mineralization even further on the northern edge of the Zone 2 area and grades of gold, silver and zinc increased at depth with the holes ending in mineralization As Dunham Craig pointed out, "our drilling continues to discover additional high grade in both Zones 2 and 4. These zones of increased grade greatly enhance the project's future economics when considering a large bulk mineable polymetallic deposit.

The interesting thing about San Agustin is that the deposit appears to consist of two different types of mineralization. Northeast of the historical resource it is primarily in higher grade gold-silver structures, whereas to the south west of the historical resource there seems to be an extensive system of gold-silver-zinc-lead mineralization Comparisons were made by Sig Weidner, when he was in London recently, with the Penasquito mine, also in Mexico, where Goldcorp intends to expand production to around 1.7 million ounces of gold equivalent at a capital cost of US$1.49 million. If this comparison holds up Geologix will really be onto something and the resource calculation due next summer should reveal a lot.

The company also has a strategic alliance with Newmont in central Peru where first-pass regional geochemical evaluation consisting of Newmont's proprietary BLEG technique as well as stream-sediment and rock sampling of the Alliance's 11,000 square kilometres has now been completed. Over 14,800 samples have been collected within the alliance boundary that provide a comprehensive and compelling database for definition of anomalous areas. Follow-up geological investigation of numerous identified targets is underway and this will have priority over the other early stage projects in Peru which Geologix has a 100 per cent interest.

Its projects in Nevada are slightly more advanced and some are being considered for joint ventures to limit the company's exploration spend. Some drilling is taking place at the OZ project and the QC project will be drilled next summer. Most of the investment interest is, however, focused on San Agustin and the build-up to the resource estimate next year should be worth monitoring.

Labels:

GIX

Tuesday, December 18, 2007

Citigroup's prediction on Gold and Copper

GOLD

Citigroup observed that "gold is oscillating around $800/oz as speculators have locked in profits. We view the outlook favorable for a test of $1,000."

The analysts said they see precious metals "as well-positioned given the inherently re-flationary implication of Fed and Central Bank action. We would expect strong safe-haven demand in the event of U.S. recession." However, the analysts also noted that gold equities have been underperforming bullion in the fourth quarter "as investment demand has slackened.

Meanwhile, "the IMF is taking measures (e.g. job cuts) aimed at convincing the U.S. and Europe to allow 400 tonnes of gold sales," according to the analysts.

Hill and Wark indicated that "gold shares have finally delivered, after languishing due to the [investment] ‘physical bypass' and high relative multiples compared to FCF-rich [free cash flow-rich] bulk/base miners." They even forecast that "the market is also likely to be shocked at how much cash the major golds generate at $800/oz.'

COPPER

The analysts said they favor copper "as the most defensive, yet aggressively pro-cyclical, China-centric industrial metal." While noting that copper spot prices have fallen below $3/lb., Hill and Wark also affirmed that "medium/long-term dated futures have rallied, suggesting: 1) Metals traders believe a U.S. recession will be shallow, with little spillover to China or 2009/10; and 2) Replacement cost is $2.50/lb."

Other factors highlighted in the Citigroup analysis of copper revealed that November imports were up in China, while Shanghai inventories have declined 57% from October peaks. Smelter TC/RCs are settling low even though there is more available spot concentrate. China Minmet and Jiangxi Copper have agreed to buy out Northern Peru to access resources in Peru. Finally, the cancellation of the Galore Creek project development by NovaGold and Teck Cominco illustrates "the difficulty of developing large, low-grade deposits in remote locations," according to the analysts.

Hill and Wark found that metals futures have been more durable than spot. "This explains why the equities have been insulated and defies headline fears of falling demand from development economies."

Meanwhile, "the futures market suggests the mean expectation is for copper to remain above $2.60/lb ($5,700/T) for the next five years," Citigroup said, adding that "new copper projects probably require $2.00 - $2.50/lb., depending on views of political risk.

Citigroup observed that "gold is oscillating around $800/oz as speculators have locked in profits. We view the outlook favorable for a test of $1,000."

The analysts said they see precious metals "as well-positioned given the inherently re-flationary implication of Fed and Central Bank action. We would expect strong safe-haven demand in the event of U.S. recession." However, the analysts also noted that gold equities have been underperforming bullion in the fourth quarter "as investment demand has slackened.

Meanwhile, "the IMF is taking measures (e.g. job cuts) aimed at convincing the U.S. and Europe to allow 400 tonnes of gold sales," according to the analysts.

Hill and Wark indicated that "gold shares have finally delivered, after languishing due to the [investment] ‘physical bypass' and high relative multiples compared to FCF-rich [free cash flow-rich] bulk/base miners." They even forecast that "the market is also likely to be shocked at how much cash the major golds generate at $800/oz.'

COPPER

The analysts said they favor copper "as the most defensive, yet aggressively pro-cyclical, China-centric industrial metal." While noting that copper spot prices have fallen below $3/lb., Hill and Wark also affirmed that "medium/long-term dated futures have rallied, suggesting: 1) Metals traders believe a U.S. recession will be shallow, with little spillover to China or 2009/10; and 2) Replacement cost is $2.50/lb."

Other factors highlighted in the Citigroup analysis of copper revealed that November imports were up in China, while Shanghai inventories have declined 57% from October peaks. Smelter TC/RCs are settling low even though there is more available spot concentrate. China Minmet and Jiangxi Copper have agreed to buy out Northern Peru to access resources in Peru. Finally, the cancellation of the Galore Creek project development by NovaGold and Teck Cominco illustrates "the difficulty of developing large, low-grade deposits in remote locations," according to the analysts.

Hill and Wark found that metals futures have been more durable than spot. "This explains why the equities have been insulated and defies headline fears of falling demand from development economies."

Meanwhile, "the futures market suggests the mean expectation is for copper to remain above $2.60/lb ($5,700/T) for the next five years," Citigroup said, adding that "new copper projects probably require $2.00 - $2.50/lb., depending on views of political risk.

Tuesday, December 4, 2007

Too Young to die

Analyst Eric Hommelberg mentioned Goldman would be wrong again this time. Take a peek at the December 2005 peak in gold. Indeed very similar to the one we just witnessed in November 2007 right? Guess what gold prices Goldman Sachs were predicting in December 2005 for the following 12 months?

Well, their forecast concerned gold prices by end of 2006 in the $470 - $510 range. Needless to say they were wrong and they will be wrong this time again. It goes far beyound the scope to discuss Goldman’s hidden agenda for predicting lower gold prices but the bottom line is that predicting lower gold prices is predicting an appreciating dollar. An appreciating dollar however could be regarded as science fiction during times of severe financial stress in the US banking sector, current account deficits exceeding $800 billion per year, exploding costs of the middle east war (multiple trillion) and foreign countries looking for options to diversify out of the dollar.

Well, their forecast concerned gold prices by end of 2006 in the $470 - $510 range. Needless to say they were wrong and they will be wrong this time again. It goes far beyound the scope to discuss Goldman’s hidden agenda for predicting lower gold prices but the bottom line is that predicting lower gold prices is predicting an appreciating dollar. An appreciating dollar however could be regarded as science fiction during times of severe financial stress in the US banking sector, current account deficits exceeding $800 billion per year, exploding costs of the middle east war (multiple trillion) and foreign countries looking for options to diversify out of the dollar.

Friday, November 30, 2007

Short gold in '08, Goldman says

Globe and Mail Update

November 29, 2007 at 3:03 PM EST

Gold bugs have mostly had it all their own way this year, but that won't be the case next year, Goldman Sachs Group Inc. believes. In fact, the big brokerage firm recommends in its top 10 trades list for 2008 that investors short gold next year.

Goldman had recommended investors go long gold in its top 10 trades list for 2006 and bullion went from around $500 (U.S.) an ounce to $650 at the end of that year. Bullion has continued to climb since. This year it rose from $636 at the beginning of the year to as high as $845 on Nov. 7 and is currently changing hands at aound $795 on the London Metal Exchange.

But the 2008 top trades list, drawn up by Goldman's global markets team, suggests investors short gold priced in U.S. dollars in order to capitalize on a gradual relaxation of credit concerns in the financial sector over the coming months and as an avenue to benefit from the prospect of the U.S. dollar stabilizing. Bullion has been one of the main beneficiaries of the financial turmoil that began in August as investors sought alternative stores of value to the weakening U.S. dollar.

(A short sale occurs when the seller borrows a stock, commodity or currency and sells it, expecting the price to fall. If it does, the seller buys it at the lower price to replace the commodity that was borrowed.) The team anticipates that the greenback, which had a tough time in 2007 against global currencies including the Canadian dollar and the euro, will find its footing next year as the U.S. Federal Reserve Board cuts interest rates and thereby lowers the risk of a recession, and the U.S. trade balance improves further.

The team also makes its argument for shorting bullion on the basis of technical analysis. That, the team says, suggests that gold is topping out and that longer-term momentum indicators are turning lower. “We see scope for acceleration through $770 to re-test the $600-650 levels prevailing ahead of the summer,” the team said.

The team also suggests investors short small capitalization stocks and go long large caps and opt for stocks from a variety of countries, given the risk of choosing stocks from just one country.

Another of the top 10 trades for next year is to short 10-year Canadian bond futures and go instead for 10-year Swiss franc bond swaps as the rate differential between the two has gotten out of whack.

A further one is to go short the British pound and long the Japanese yen to capitalize on the expected slowing of the British economy.

“Sterling remains one of the most overvalued major currencies” in Goldman's trade-weighted valuation metric while the yen is comparatively cheap, the team said.

“On top of this, the narrowing of interest rate differentials between Japan and other major industrialized countries, including the U.K., make Japanese yen funded carry trades less attractive,” the team added.

November 29, 2007 at 3:03 PM EST

Gold bugs have mostly had it all their own way this year, but that won't be the case next year, Goldman Sachs Group Inc. believes. In fact, the big brokerage firm recommends in its top 10 trades list for 2008 that investors short gold next year.

Goldman had recommended investors go long gold in its top 10 trades list for 2006 and bullion went from around $500 (U.S.) an ounce to $650 at the end of that year. Bullion has continued to climb since. This year it rose from $636 at the beginning of the year to as high as $845 on Nov. 7 and is currently changing hands at aound $795 on the London Metal Exchange.

But the 2008 top trades list, drawn up by Goldman's global markets team, suggests investors short gold priced in U.S. dollars in order to capitalize on a gradual relaxation of credit concerns in the financial sector over the coming months and as an avenue to benefit from the prospect of the U.S. dollar stabilizing. Bullion has been one of the main beneficiaries of the financial turmoil that began in August as investors sought alternative stores of value to the weakening U.S. dollar.

(A short sale occurs when the seller borrows a stock, commodity or currency and sells it, expecting the price to fall. If it does, the seller buys it at the lower price to replace the commodity that was borrowed.) The team anticipates that the greenback, which had a tough time in 2007 against global currencies including the Canadian dollar and the euro, will find its footing next year as the U.S. Federal Reserve Board cuts interest rates and thereby lowers the risk of a recession, and the U.S. trade balance improves further.

The team also makes its argument for shorting bullion on the basis of technical analysis. That, the team says, suggests that gold is topping out and that longer-term momentum indicators are turning lower. “We see scope for acceleration through $770 to re-test the $600-650 levels prevailing ahead of the summer,” the team said.

The team also suggests investors short small capitalization stocks and go long large caps and opt for stocks from a variety of countries, given the risk of choosing stocks from just one country.

Another of the top 10 trades for next year is to short 10-year Canadian bond futures and go instead for 10-year Swiss franc bond swaps as the rate differential between the two has gotten out of whack.

A further one is to go short the British pound and long the Japanese yen to capitalize on the expected slowing of the British economy.

“Sterling remains one of the most overvalued major currencies” in Goldman's trade-weighted valuation metric while the yen is comparatively cheap, the team said.

“On top of this, the narrowing of interest rate differentials between Japan and other major industrialized countries, including the U.K., make Japanese yen funded carry trades less attractive,” the team added.

Thursday, November 22, 2007

4 picks from 2 top fund managers

Thomas Winmill of the Midas Fund (MIDSX) and Frank Holmes of the U.S. Global Investors World Precious Minerals Fund (UNWPX). Winmill's fund is the No. 1-ranked fund for total returns this year, and Holmes' fund topped the charts last year.

Winmill suggests sticking with mining companies with assets in countries whose legal systems make it harder to wriggle out of contracts. He puts the U.S., Canada, Mexico, Finland, Sweden and Australia on this list.

Next, you want to go with mining companies that have huge, undeveloped deposits that will rise in value as gold crosses over $1,000. "There is scarcity value. As gold prices go up, the value of these deposits can go up enormously," he says.

Winmill puts NovaGold Resources (NG, news, msgs) at the top of the list for both criteria. It owns the rights to a huge gold deposit in Alaska called Donlin Creek, which could hold as much as 33 million ounces of gold. "That is one of the biggest deposits in the world, and the biggest in all of the politically safe countries in the world," says Winmill.

Donlin Creek also contains big copper deposits. NovaGold Resources has a joint venture agreement with Barrick Gold to develop Donlin Creek, which adds credibility to its story. NovaGold has three or four other significant gold fields in Alaska and British Columbia.

"The company has successfully pursued a strategy of tying up large deposits when commodity prices were low and is now bringing these toward production," says Citigroup's Hill, who has a buy rating on the stock. Even before that happens, NovaGold Resources could get taken over because its holdings are so attractive, says Winmill.

Winmill also likes Northern Dynasty Minerals (NAK, news, msgs), which has a huge gold, copper and molybdenum project in Alaska called Pebble. The chairman of Northern Dynasty is Robert Dickinson of Hunter Dickinson, a private Vancouver, British Columbia, mining company that has a good record for finding developing precious metal assets, says Winmill.

Northern Dynasty has a joint venture with Anglo American (AAUK, news, msgs) to develop Pebble. And the mining company Rio Tinto (RTP, news, msgs) has a 19% stake in Northern Dynasty. Close ties with both of those companies suggest either one could buy out Northern Dynasty to get full control of its assets, believes Winmill. "My instinct is someone is going to acquire the company, and it would be good fit with Anglo American and Rio Tinto," he says.

Raymond James Financial (RJF, news, msgs) analyst Tom Meyer describes Northern Dynasty as an "ideal way" to get exposure to precious metals, in part because its shares look cheap compared with peers.

Two favorite gold mining picks of U.S. Global Investors' Holmes are Yamana Gold (AUY, news, msgs) and Goldcorp (GG, news, msgs). Yamana Gold operates several mines in Brazil. The biggest is a cash cow called Chapada where production is growing so fast that the mine helped gold production at Yamana increase by 48% in the past quarter. The company also has several exploration projects in Brazil, Argentina and Nicaragua which it believes will more than double its gold production to 2.2 million ounces a year in five years. Yamana Gold recently agreed to purchase Meridian Gold (MDG, news, msgs) at a price that was low enough so that the merger will add substantially to earnings over time, says Holmes.

Holmes favors Goldcorp because it has stakes in big gold and copper mining projects in Canada and Argentina whose growth contributed to 28% production growth at the company in the last quarter. Goldcorp also has about the lowest costs among the major gold producers. It recently forecast that it will produce gold at an average cost of $150 per ounce in 2007, once credits for the sale of copper and other mining byproducts are factored in. Holmes also believes Goldcorp has a lot of upside potential because it is developing a large gold, silver and zinc project in Mexico called Peñasquito.

Winmill suggests sticking with mining companies with assets in countries whose legal systems make it harder to wriggle out of contracts. He puts the U.S., Canada, Mexico, Finland, Sweden and Australia on this list.

Next, you want to go with mining companies that have huge, undeveloped deposits that will rise in value as gold crosses over $1,000. "There is scarcity value. As gold prices go up, the value of these deposits can go up enormously," he says.

Winmill puts NovaGold Resources (NG, news, msgs) at the top of the list for both criteria. It owns the rights to a huge gold deposit in Alaska called Donlin Creek, which could hold as much as 33 million ounces of gold. "That is one of the biggest deposits in the world, and the biggest in all of the politically safe countries in the world," says Winmill.

Donlin Creek also contains big copper deposits. NovaGold Resources has a joint venture agreement with Barrick Gold to develop Donlin Creek, which adds credibility to its story. NovaGold has three or four other significant gold fields in Alaska and British Columbia.

"The company has successfully pursued a strategy of tying up large deposits when commodity prices were low and is now bringing these toward production," says Citigroup's Hill, who has a buy rating on the stock. Even before that happens, NovaGold Resources could get taken over because its holdings are so attractive, says Winmill.

Winmill also likes Northern Dynasty Minerals (NAK, news, msgs), which has a huge gold, copper and molybdenum project in Alaska called Pebble. The chairman of Northern Dynasty is Robert Dickinson of Hunter Dickinson, a private Vancouver, British Columbia, mining company that has a good record for finding developing precious metal assets, says Winmill.

Northern Dynasty has a joint venture with Anglo American (AAUK, news, msgs) to develop Pebble. And the mining company Rio Tinto (RTP, news, msgs) has a 19% stake in Northern Dynasty. Close ties with both of those companies suggest either one could buy out Northern Dynasty to get full control of its assets, believes Winmill. "My instinct is someone is going to acquire the company, and it would be good fit with Anglo American and Rio Tinto," he says.

Raymond James Financial (RJF, news, msgs) analyst Tom Meyer describes Northern Dynasty as an "ideal way" to get exposure to precious metals, in part because its shares look cheap compared with peers.

Two favorite gold mining picks of U.S. Global Investors' Holmes are Yamana Gold (AUY, news, msgs) and Goldcorp (GG, news, msgs). Yamana Gold operates several mines in Brazil. The biggest is a cash cow called Chapada where production is growing so fast that the mine helped gold production at Yamana increase by 48% in the past quarter. The company also has several exploration projects in Brazil, Argentina and Nicaragua which it believes will more than double its gold production to 2.2 million ounces a year in five years. Yamana Gold recently agreed to purchase Meridian Gold (MDG, news, msgs) at a price that was low enough so that the merger will add substantially to earnings over time, says Holmes.

Holmes favors Goldcorp because it has stakes in big gold and copper mining projects in Canada and Argentina whose growth contributed to 28% production growth at the company in the last quarter. Goldcorp also has about the lowest costs among the major gold producers. It recently forecast that it will produce gold at an average cost of $150 per ounce in 2007, once credits for the sale of copper and other mining byproducts are factored in. Holmes also believes Goldcorp has a lot of upside potential because it is developing a large gold, silver and zinc project in Mexico called Peñasquito.

Friday, November 9, 2007

Buy Crosshair

Have watched Crosshair (CXX.V) on the radar for two years, I bought it today at $2.26. This unranium explorer have done very well recently. I missed it two years ago because some pundit told me it was a hype which you can tell from the company name.

Long term unranium should be a clean fuel solution.

Long term unranium should be a clean fuel solution.

Saturday, November 3, 2007

Take a position on ECU

ECU is getting interesting after it reported new discovery and obviously it was accumulated by somebody. Technical chart is set up exactly what I want to see. I took a position for this stock at $2.14 yesterday.

Wednesday, October 31, 2007

ECU Silver

ECU came to my radar two days ag. This company made a new discovery recently. It looks like it has potential to grow to a major silver producer in Maxico, like EXK. Technically this share had bullish MACD crossover.

I failed to buy this stock today at $2.18 at last minute of trading. Maybe tomorrow.

I failed to buy this stock today at $2.18 at last minute of trading. Maybe tomorrow.

Thursday, September 6, 2007

Comments on NDM

The following are the comments from most respectful person, Perter Grandich

I've spoken to both the Chairman and President of NDM at length and to all of our knowledge there is nothing out of the ordinary happening. In fact, thanks to the Anglo deal, management has never been more confident. Personally, I think we've witnessed distress selling that leads to more selling. Because I think we're seeing signs of this exhaustion coming to an end and the fact that gold has broken out to the upside, I've done something I haven't done in years - I purchased 200 November 7 ½ call options on NDM at 2 ¾.

I continue to believe NDM is the most undervalued non-producing copper-gold stock in the world today, and view the current share price as one of the most undervalued situations in my nearly 25 years of investing.

I've spoken to both the Chairman and President of NDM at length and to all of our knowledge there is nothing out of the ordinary happening. In fact, thanks to the Anglo deal, management has never been more confident. Personally, I think we've witnessed distress selling that leads to more selling. Because I think we're seeing signs of this exhaustion coming to an end and the fact that gold has broken out to the upside, I've done something I haven't done in years - I purchased 200 November 7 ½ call options on NDM at 2 ¾.

I continue to believe NDM is the most undervalued non-producing copper-gold stock in the world today, and view the current share price as one of the most undervalued situations in my nearly 25 years of investing.

Sunday, August 26, 2007

Where are we now?

US$ is dropping again when it hit the resistance. We will see soon whethere it will broke down under 80.

Crude is still below the up trend. But it may or may not touch the support line at around $67 which depends on the hurricane category. Personally I wish it drop to that level so that I can pick up cheap.

Gold is well supported even the whole market was sell-off on August 16, including the gold stocks.

HUI was broke down technically. The sentiment is damaged. MACD of HUI:Gold seems to crossover positively. Watch the US$ closely for any clue.

\

Friday, August 24, 2007

Another week after sell-off

August 16, last Thursday, the market was sell-off no matter what should be sold. People rushed to sell what they can to sell. It was not end of the world, but just a bloody lesson to learn in the risky market.

Gold is hold well this week when US$ seems to be under pressure again, especially FED might take whatever they have to keep the market alive, which means the interest rate may be cut sooner than later.

I would not sell anything I have, but look to buy.

LV is oversold now. the CEO of LV is buying last week, and buying a lot between 0.60-0.70. That's a promising sign.

NDM is stabilized at this level. Trader may not satisfied with their recent JV. But its massive reserve is definite a target of any major.

I feel much better now.

Gold is hold well this week when US$ seems to be under pressure again, especially FED might take whatever they have to keep the market alive, which means the interest rate may be cut sooner than later.

I would not sell anything I have, but look to buy.

LV is oversold now. the CEO of LV is buying last week, and buying a lot between 0.60-0.70. That's a promising sign.

NDM is stabilized at this level. Trader may not satisfied with their recent JV. But its massive reserve is definite a target of any major.

I feel much better now.

Thursday, August 16, 2007

Everything has been marked down

Today, August 16, 2007, should be recorded in the history. TSX was dropped 500 points before bounce back, a bigger drop than in 911. Everything is marked down indiscriminated, including the best things you can own today in the market. It gives me a bloody lessen which is never learned and experienced.

The trades are forced to be investment, probably a long-term investment. It might take weeks or months to recover emotionally and physically.

Finally, my ultimate peace of mind doesn’t come from the price on a computer screen but knowing my Lord & Savior Jesus Christ is 100% in charge, especially now!

The trades are forced to be investment, probably a long-term investment. It might take weeks or months to recover emotionally and physically.

Finally, my ultimate peace of mind doesn’t come from the price on a computer screen but knowing my Lord & Savior Jesus Christ is 100% in charge, especially now!

Sunday, August 12, 2007

Gold is still on up trend

Crude is under pressure if there is no Katrina in gulf coast this summer. MACD is down and it expects support at $64-$66 range.

USD is bouncing back now. But it is still in the down trend.

Gold is supported on up trend. obviously we see high and high.

I am very disappointed with LV although there is no bad news at all for this company. Share price plunged again. I would not sell it at this level.

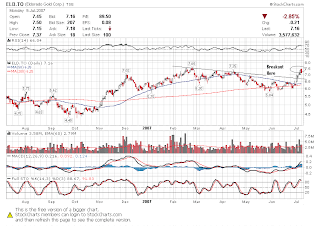

Friday I placed BUY order at $1.38 for GIX. Unfortunately it did not get through because it quickly bounced up to $1.58. It definately is a BUY below $1.40.

It looks like some fund managers do not like NDM because of the JV and it was not bought out. I believe the best yet to come.

Tuesday, August 7, 2007

House of Pain

It is house of pain when you seeing stock radar turns red. But I am not going to back off from Gold stocks. USD is just bouncing back a bit as expected. I am looking for adding more, such as FAN, GIX, and EDR, when they dip further.

Friday, August 3, 2007

Replace carpet with hardword floor

Finally I got one week vacation to do a home project, replacing carpet with hardwood floor. It should be done two months ago after I bought the hardwood floor. It is a tough job, my first do-it-myself home project in Canada. Thanks God for having Robin, Rocky and Barry to help me out in the first day. I strongly felt it was God's will to do this project myself, learn to do it right, enjoy the accomplishment and bring the glory to our Lord.

Friday, July 27, 2007

Stick with NDM

NDM shoot up more than 9% with high volume when Gold is in correction mode. On my gold stock radar, NDM pops up in Green when the rest are in Red. Stick with NDM and do not get washed out. We are getting closer to the target.

Good and bad experience tell me that I had to hold on the Gold stocks in this dip and buy more. Gold is the final winner.

Good and bad experience tell me that I had to hold on the Gold stocks in this dip and buy more. Gold is the final winner.

Thursday, July 26, 2007

NDM looks much better

NDM is a screaming BUY here. NDM is up when the whole market is down today. Something is approaching. Here is the news except:

Bruce Jenkins, Northern Dynasty's chief operating officer, confirmed in a separate interview held earlier in July that Northern Dynasty has signed confidentiality agreements with more than a dozen mining companies that are interested in becoming partners in the mine. Jenkins would not identify the companies.

Raymond James yesterday had a new report on NDM, mentioning target price is $25. I am expecting more bullish comments to follow.

Bruce Jenkins, Northern Dynasty's chief operating officer, confirmed in a separate interview held earlier in July that Northern Dynasty has signed confidentiality agreements with more than a dozen mining companies that are interested in becoming partners in the mine. Jenkins would not identify the companies.

Raymond James yesterday had a new report on NDM, mentioning target price is $25. I am expecting more bullish comments to follow.

Tuesday, July 24, 2007

Buy second batch of GIX

Today GIX was pulled back as the Gold Stocks. Although there could be further downside, I bought another batch GIX at $1.98 for long term holding.

Today's pullback of gold stocks seems profit-taking and market expectation of USD rebound from oversold. Never underestimate the PPT's power. The question is how big it is.

Today's pullback of gold stocks seems profit-taking and market expectation of USD rebound from oversold. Never underestimate the PPT's power. The question is how big it is.

Sunday, July 22, 2007

Portfolio Update

NDM: Expecting some big news while the company is keeping quite recently.

RDI: Trading volume is bigger than befor.

LV. The worst is over.

ATW: Let's see when the winter, our summer is over and they start to drill.

GIX: It is getting interesting. I am thinking to add new position if it keeps climbing.

ELD: Hopefully their CEO's optimism is justified.

EDR, EXK: According to their web site, their objective is to be top 5 silver producer in the world. They will be doing well if the silver is on track.

JNJ: Disappointed on their forecast although it may be conservative. I don't want to hold something which is out of favor.

K: It is my replacement to AEM.

Saturday, July 21, 2007

JNJ's problem

It may not be a good time to own this stock as the growth is slowing, and generic is a threat. I sold this stock with a slight loss yesterday.

Tuesday, July 17, 2007

JNJ is down one dollar

JNJ post a good result of second quarter but still dowm one dollar. But it recovered from its intraday low a little bit. I will listen the conference call meeting tonight because I had to work during the day.

ELD kept going down as I thought. The question is when is the turnaround point.

ELD kept going down as I thought. The question is when is the turnaround point.

Monday, July 16, 2007

USD is oversold

USD is oversold as seen the chart above when RSI below 30. Short term USD may rebound and Gold is going to consolidate, which might be the last chance to buy. ELD dropped faster than its peer today. The interest question is how far it can go down, when the CEO is still upbeat. I think the problem in Turkey can be fixed.

Sunday, July 15, 2007

Saturday, July 14, 2007

Buy EXK

Bought EXK at US$ 5.06 yesterady because it was weak in bull trend and investing in Candadian company is better off than holding US dollar now.

Thursday, July 12, 2007

It is a sad day for ELD share holder

This morning I leared that one the ELD gold mine in Turkey had to be shut down due to the court ruling in 30 days. When I got to office, the internet was down so I could not sell it in time. When I got to be connected, ELD was down 30%, the biggest in its history and erased all gain since last year. This is the kind of risk you had to take.

I think it still has downside tommorrow. But since I don't know exactly what is going on there, I would rather hang on for a while.

I think it still has downside tommorrow. But since I don't know exactly what is going on there, I would rather hang on for a while.

Wednesday, July 11, 2007

Buy JNJ and Kinross

This morning I bought JNJ and Kinross at US$62.43 and CAN$ 13.93 for longer term investment.

JNJ is big pharm in US. It just announced 10B buyback plan which I do believe a boost. MACD is positive cross-over.

Kinross is another Gold play especially when Gold is marching to $700 in the next two months.

Another Stock I would like to buy is Canadian Rail. But it moved too quick to buy. I will wait for its pullback. No hurry.

Tuesday, July 10, 2007

RDI is under accumulation

RDI is a diamond company in South Africa and well-run company. It consistently generate cash flow every month. Currently volume started to increase and price is climbing. someboy must accumulate this stock around $0.60 - $0.65 for quite a while. It won't surprise me if it goes to above $1.00 in the next two months.

Today it closed at $0.77.

Today it closed at $0.77.

Monday, July 9, 2007

Friday, July 6, 2007

Buy ELD and EDR at market price

This morning when I am on business trip, the gold stocks are up a lot. They might come back a bit. But I believe long term gold is getting stronger. I bought ELD and EDR at market price at $7.39 and $5.13.

I think ELD and EDR are better leverage to AEM and SLW because of their size. But I am still bullish on SLW and AEM.

I think ELD and EDR are better leverage to AEM and SLW because of their size. But I am still bullish on SLW and AEM.

Thursday, July 5, 2007

ELD moved too fast to buy

Today two buy orders failed because both ELD and EDR moved too fast and did not look back to my buy point at $6.98 and $4.88. I believe ELD is a take-over target. Fundamentally they just found new gold in CHINA.

What's going on with AEM?It moves up quickly when Gold is down today.

What's going on with AEM?It moves up quickly when Gold is down today.

Tuesday, July 3, 2007

Before Indenpendence Day

Tomorrow US market will be closed. Traders are still on vacation. SLW kept climbing even Gold is pulled back almost $4.00. Am I washed out when I sold SLW, EXK and AEM two weeks ago?

NDM is encoraging finished at $12.91 up 3%. Grandich is expecting it to be double at least. I am betting on NDM now.

GIX did not hold support at $1.60 and dip to $1.54 (-3.75%). I will buy if it went to $1.40.

LV seems to be stabilized at $1.10, another top pick of Grandich.

NDM is encoraging finished at $12.91 up 3%. Grandich is expecting it to be double at least. I am betting on NDM now.

GIX did not hold support at $1.60 and dip to $1.54 (-3.75%). I will buy if it went to $1.40.

LV seems to be stabilized at $1.10, another top pick of Grandich.

Monday, July 2, 2007

When TSX Closed

Today TSX is closed due to Canada Day while Gold is climbing to $658. Both EXK and SLW traded in the States are doing well.

Holding by the end of first half year

NDM $12.50

RDI $0.70

LV $1.10

ATW $0.60

GIX $1.60

Holding by the end of first half year

NDM $12.50

RDI $0.70

LV $1.10

ATW $0.60

GIX $1.60

Sunday, July 1, 2007

Waiting for Pullback

Gold has been under pressure for quite a while. My favarite stocks are AEM, SLW, and EXK although I am in cash now. Some technicians are bearish on gold and expect further downward to $600.

Shall I wait ? I may miss the train which go to $2000 if I wait too long.

Shall I wait ? I may miss the train which go to $2000 if I wait too long.

Subscribe to:

Posts (Atom)