NDM shoot up more than 9% with high volume when Gold is in correction mode. On my gold stock radar, NDM pops up in Green when the rest are in Red. Stick with NDM and do not get washed out. We are getting closer to the target.

Good and bad experience tell me that I had to hold on the Gold stocks in this dip and buy more. Gold is the final winner.

Friday, July 27, 2007

Thursday, July 26, 2007

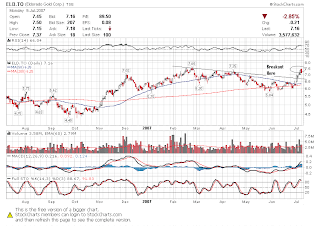

NDM looks much better

NDM is a screaming BUY here. NDM is up when the whole market is down today. Something is approaching. Here is the news except:

Bruce Jenkins, Northern Dynasty's chief operating officer, confirmed in a separate interview held earlier in July that Northern Dynasty has signed confidentiality agreements with more than a dozen mining companies that are interested in becoming partners in the mine. Jenkins would not identify the companies.

Raymond James yesterday had a new report on NDM, mentioning target price is $25. I am expecting more bullish comments to follow.

Bruce Jenkins, Northern Dynasty's chief operating officer, confirmed in a separate interview held earlier in July that Northern Dynasty has signed confidentiality agreements with more than a dozen mining companies that are interested in becoming partners in the mine. Jenkins would not identify the companies.

Raymond James yesterday had a new report on NDM, mentioning target price is $25. I am expecting more bullish comments to follow.

Tuesday, July 24, 2007

Buy second batch of GIX

Today GIX was pulled back as the Gold Stocks. Although there could be further downside, I bought another batch GIX at $1.98 for long term holding.

Today's pullback of gold stocks seems profit-taking and market expectation of USD rebound from oversold. Never underestimate the PPT's power. The question is how big it is.

Today's pullback of gold stocks seems profit-taking and market expectation of USD rebound from oversold. Never underestimate the PPT's power. The question is how big it is.

Sunday, July 22, 2007

Portfolio Update

NDM: Expecting some big news while the company is keeping quite recently.

RDI: Trading volume is bigger than befor.

LV. The worst is over.

ATW: Let's see when the winter, our summer is over and they start to drill.

GIX: It is getting interesting. I am thinking to add new position if it keeps climbing.

ELD: Hopefully their CEO's optimism is justified.

EDR, EXK: According to their web site, their objective is to be top 5 silver producer in the world. They will be doing well if the silver is on track.

JNJ: Disappointed on their forecast although it may be conservative. I don't want to hold something which is out of favor.

K: It is my replacement to AEM.

Saturday, July 21, 2007

JNJ's problem

It may not be a good time to own this stock as the growth is slowing, and generic is a threat. I sold this stock with a slight loss yesterday.

Tuesday, July 17, 2007

JNJ is down one dollar

JNJ post a good result of second quarter but still dowm one dollar. But it recovered from its intraday low a little bit. I will listen the conference call meeting tonight because I had to work during the day.

ELD kept going down as I thought. The question is when is the turnaround point.

ELD kept going down as I thought. The question is when is the turnaround point.

Monday, July 16, 2007

USD is oversold

USD is oversold as seen the chart above when RSI below 30. Short term USD may rebound and Gold is going to consolidate, which might be the last chance to buy. ELD dropped faster than its peer today. The interest question is how far it can go down, when the CEO is still upbeat. I think the problem in Turkey can be fixed.

Sunday, July 15, 2007

Saturday, July 14, 2007

Buy EXK

Bought EXK at US$ 5.06 yesterady because it was weak in bull trend and investing in Candadian company is better off than holding US dollar now.

Thursday, July 12, 2007

It is a sad day for ELD share holder

This morning I leared that one the ELD gold mine in Turkey had to be shut down due to the court ruling in 30 days. When I got to office, the internet was down so I could not sell it in time. When I got to be connected, ELD was down 30%, the biggest in its history and erased all gain since last year. This is the kind of risk you had to take.

I think it still has downside tommorrow. But since I don't know exactly what is going on there, I would rather hang on for a while.

I think it still has downside tommorrow. But since I don't know exactly what is going on there, I would rather hang on for a while.

Wednesday, July 11, 2007

Buy JNJ and Kinross

This morning I bought JNJ and Kinross at US$62.43 and CAN$ 13.93 for longer term investment.

JNJ is big pharm in US. It just announced 10B buyback plan which I do believe a boost. MACD is positive cross-over.

Kinross is another Gold play especially when Gold is marching to $700 in the next two months.

Another Stock I would like to buy is Canadian Rail. But it moved too quick to buy. I will wait for its pullback. No hurry.

Tuesday, July 10, 2007

RDI is under accumulation

RDI is a diamond company in South Africa and well-run company. It consistently generate cash flow every month. Currently volume started to increase and price is climbing. someboy must accumulate this stock around $0.60 - $0.65 for quite a while. It won't surprise me if it goes to above $1.00 in the next two months.

Today it closed at $0.77.

Today it closed at $0.77.

Monday, July 9, 2007

Friday, July 6, 2007

Buy ELD and EDR at market price

This morning when I am on business trip, the gold stocks are up a lot. They might come back a bit. But I believe long term gold is getting stronger. I bought ELD and EDR at market price at $7.39 and $5.13.

I think ELD and EDR are better leverage to AEM and SLW because of their size. But I am still bullish on SLW and AEM.

I think ELD and EDR are better leverage to AEM and SLW because of their size. But I am still bullish on SLW and AEM.

Thursday, July 5, 2007

ELD moved too fast to buy

Today two buy orders failed because both ELD and EDR moved too fast and did not look back to my buy point at $6.98 and $4.88. I believe ELD is a take-over target. Fundamentally they just found new gold in CHINA.

What's going on with AEM?It moves up quickly when Gold is down today.

What's going on with AEM?It moves up quickly when Gold is down today.

Tuesday, July 3, 2007

Before Indenpendence Day

Tomorrow US market will be closed. Traders are still on vacation. SLW kept climbing even Gold is pulled back almost $4.00. Am I washed out when I sold SLW, EXK and AEM two weeks ago?

NDM is encoraging finished at $12.91 up 3%. Grandich is expecting it to be double at least. I am betting on NDM now.

GIX did not hold support at $1.60 and dip to $1.54 (-3.75%). I will buy if it went to $1.40.

LV seems to be stabilized at $1.10, another top pick of Grandich.

NDM is encoraging finished at $12.91 up 3%. Grandich is expecting it to be double at least. I am betting on NDM now.

GIX did not hold support at $1.60 and dip to $1.54 (-3.75%). I will buy if it went to $1.40.

LV seems to be stabilized at $1.10, another top pick of Grandich.

Monday, July 2, 2007

When TSX Closed

Today TSX is closed due to Canada Day while Gold is climbing to $658. Both EXK and SLW traded in the States are doing well.

Holding by the end of first half year

NDM $12.50

RDI $0.70

LV $1.10

ATW $0.60

GIX $1.60

Holding by the end of first half year

NDM $12.50

RDI $0.70

LV $1.10

ATW $0.60

GIX $1.60

Sunday, July 1, 2007

Waiting for Pullback

Gold has been under pressure for quite a while. My favarite stocks are AEM, SLW, and EXK although I am in cash now. Some technicians are bearish on gold and expect further downward to $600.

Shall I wait ? I may miss the train which go to $2000 if I wait too long.

Shall I wait ? I may miss the train which go to $2000 if I wait too long.

Subscribe to:

Posts (Atom)